VISITORS TO CANADA

The Visitors to Canada plan covers your clients during their stay in Canada.

THE VISITORS TO CANADA PLAN IS PERFECT FOR:

- Foreign travellers visiting Canada

- Visitors looking for coverage that meets the Supervisa criteria

- Immigrants or permanent residents waiting for the provincial health insurance plan

- Foreign students

- Canadians who are no longer eligible for provincial health insurance following an extended absence from Canada

The contract must be purchased:

- Before the date of arrival in Canada, or

- Before the termination date of an insurance coverage in Canada similar to ours held with another insurance company, or

- Within 30 days of either of the two preceding date

Clients who purchase the plan after the effective date of another insurance contract offering similar coverage in Canada must present proof of that insurance.

How to sell the plan

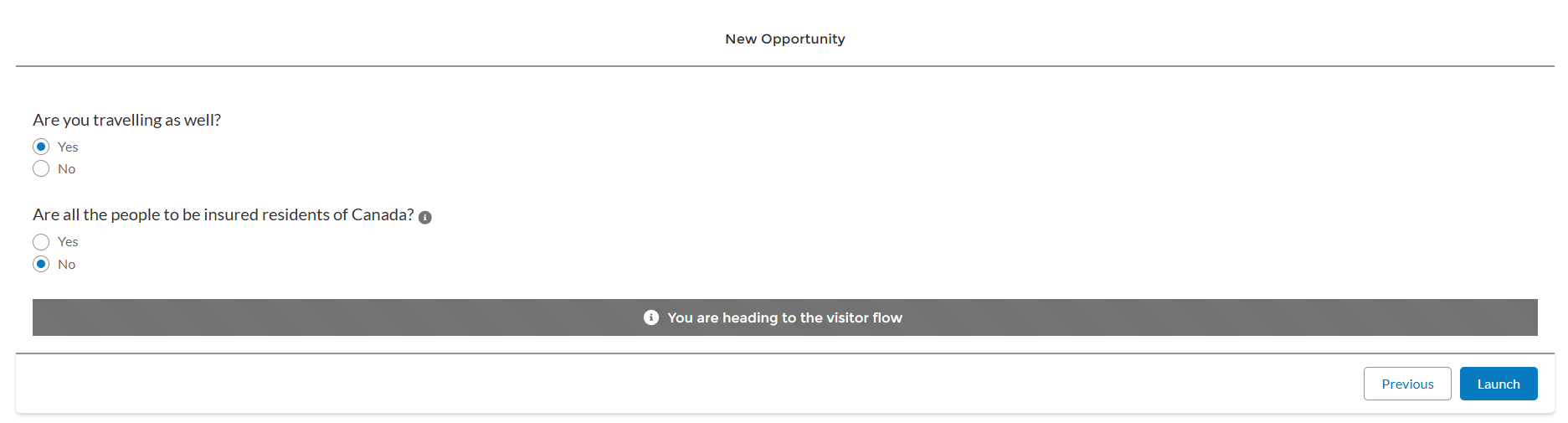

To access the Visitors to Canada sales flow, you must answer “No” when asked if all the people to be insured are residents of Canada.

Maximum coverage per person

| Coverage | Maximum coverage per person (optional) | ||

| Emergency Medical Care for visitors to Canada | Up to $150,000 | Up to $100,000 | Up to $50,000 |

Side trips

Visitors to Canada insurance applies during a stay in Canada and during side trips made outside Canada, with the exception of your client’s country of permanent residence.

- A side trip must begin and end in Canada.

- A side trip must not exceed 30 days at a time, otherwise coverage is suspended on the 31st day, until the return to Canada.

- The total duration of side trips made must not exceed 49% of the contract coverage period.

- If the total duration of the side trips exceeds 49% of the coverage period, the contract will be null and void in its entirety.

- An insured person staying in their country of permanent residence is not covered.

Trip break

The insured person may travel to their country of permanent residence and then return to Canada without the insurance contract terminating. During this period outside of Canada, no insurance coverage is valid and no premium refund is granted for days spent in the country of permanent residence.

The insured person must meet the eligibility criteria each time they return to Canada. If a change in their state of health occurs, the insured person must contact the insurer before returning to Canada.